Discover Where Your Money Is Really Going And How Much You're Losing to Hidden Fees

Are you paying thousands in unnecessary investment fees without even knowing it?

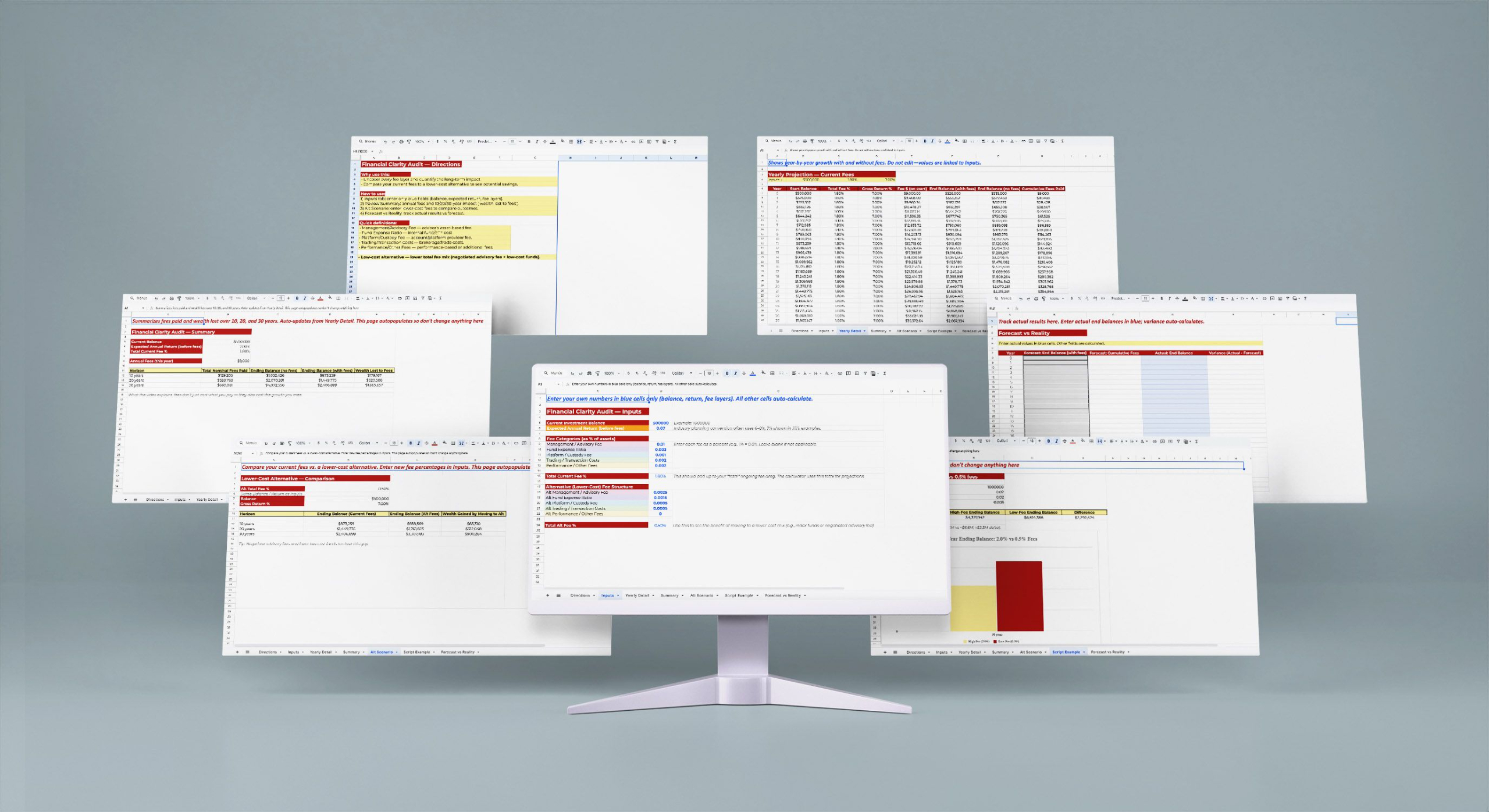

This calculator reveals your true all-in costs and shows you exactly how much those fees will cost you over 10, 20, and 30 years.

GET THE CALCULATORDiscover Where Your Money Is Really Going And How Much You're Losing to Hidden Fees

Are you paying thousands in unnecessary investment fees without even knowing it?

This calculator reveals your true all-in costs and shows you exactly how much those fees will cost you over 10, 20, and 30 years.

GET THE CALCULATORAS SEEN ON

AS SEEN ON

Join 1,000+ Women Taking Control of Their Finances

”

I had $150,000 sitting in a savings account earning just 0.5% because investing felt 'too complicated.' After working with Jill, I've doubled my investment returns, eliminated $15,000 in credit card debt, created two new income streams, built a $50,000 emergency fund, and started my own business!

— Sarah M.

”

Jill's approach completely changed how I think about money. I went from making minimum payments on my credit cards to having a clear debt freedom plan. For the first time in my life, I feel financially confident.

— Angela R.

”

After one session with Jill Collins concerning my savings : I was able to see that I have to stay on track with my money and stop blaming the system

— Soraya H.

Join 1,000+ Women Taking Control of Their Finances

”

I had $150,000 sitting in a savings account earning just 0.5% because investing felt 'too complicated.' After working with Jill, I've doubled my investment returns, eliminated $15,000 in credit card debt, created two new income streams, built a $50,000 emergency fund, and started my own business!

— Sarah M.

”

Jill's approach completely changed how I think about money. I went from making minimum payments on my credit cards to having a clear debt freedom plan. For the first time in my life, I feel financially confident.

— Angela R.

”

After one session with @iamjillcollins concerning my savings : I was able to see that I have to stay on track with my money and stop blaming the system

— Soraya Ho Sing Loy

Meet Jill Collins: Your Guide to Financial Clarity

I'm a financial educator who helps successful women transform financial confusion into complete clarity.

For years, I watched intelligent, accomplished women, executives, business owners, high earners, feel completely lost when it came to their money. They had assets. They had income. What they didn't have was a clear understanding of where their money was going.

So I created a systematic approach to financial education. No life coaching. No motivational fluff. Just practical frameworks you can actually use.

The Fee Audit Calculator is the same tool I walk my private clients through in our first session together. It consistently uncovers $10,000-$50,000+ in unnecessary annual fees.

Now I'm making it available to you.

Because every woman deserves financial clarity, regardless of whether she works with me or not.

You've worked too hard for your money to not know exactly where it's going.

Meet Jill Collins: Your Guide to Financial Clarity

I'm a financial educator who helps successful women transform financial confusion into complete clarity.

For years, I watched intelligent, accomplished women, executives, business owners, high earners, feel completely lost when it came to their money. They had assets. They had income. What they didn't have was a clear understanding of where their money was going.

So I created a systematic approach to financial education. No life coaching. No motivational fluff. Just practical frameworks you can actually use.

The Fee Audit Calculator is the same tool I walk my private clients through in our first session together. It consistently uncovers $10,000-$50,000+ in unnecessary annual fees.

Now I'm making it available to you.

Because every woman deserves financial clarity, regardless of whether she works with me or not.

You've worked too hard for your money to not know exactly where it's going.

What’s Inside the Financial Fee Clarity Audit Calculator

Three Powerful Insights That Take Only 15 Minutes

Calculate your true all-in investment costs

See exactly how much you're paying across ALL your accounts combined: advisor fees, fund expenses, platform charges, and hidden transaction costs all in one place

Project the lifetime impact of your fees

Understand how today's "small" percentages translate into hundreds of thousands of dollars over 10, 20, and 30 years of compound growth

Identify immediate savings opportunities

Discover which accounts have excessive fees and where you can cut costs right now without sacrificing service or performance

What’s Inside the Financial Fee Clarity Audit Calculator

Three Powerful Insights That Take Only 15 Minutes

Calculate your true all-in investment costs

See exactly how much you're paying across ALL your accounts combined, advisor fees, fund expenses, platform charges, and hidden transaction costs all in one place

Project the lifetime impact of your fees

Understand how today's "small" percentages translate into hundreds of thousands of dollars over 10, 20, and 30 years of compound growth

Identify immediate savings opportunities

Discover which accounts have excessive fees and where you can cut costs right now without sacrificing service or performance

This calculator is designed for successful women who:

✓ Have accumulated investment assets but feel unclear about the true costs

✓ Suspect they're overpaying but don't know how to prove it

✓ Want to understand their financial statements without feeling stupid

✓ Are ready to have an informed conversation with their advisor

✓ Value clarity, systems, and taking control of their money

✓ Have 15-20 minutes to invest in their financial education

You don't need to be a financial expert to use this calculator. You just need to be ready for answers.

If you've been wondering "Am I paying too much?", this tool will tell you exactly how much, and what it's really costing you.

This calculator is designed for successful women who:

✓ Have accumulated investment assets but feel unclear about the true costs

✓ Suspect they're overpaying but don't know how to prove it

✓ Want to understand their financial statements without feeling stupid

✓ Are ready to have an informed conversation with their advisor

✓ Value clarity, systems, and taking control of their money

✓ Have 15-20 minutes to invest in their financial education

You don't need to be a financial expert to use this calculator. You just need to be ready for answers.

If you've been wondering "Am I paying too much?", this tool will tell you exactly how much, and what it's really costing you.

You're Successful in Every Other Area...

So, Why Does Your Financial Situation Feel So Unclear?

You've built a six-figure income.

You've accumulated assets.

You have investment accounts and a financial advisor.

But when you look at your statements, you see confusion:

-

Management fees, fund fees, platform fees, which ones actually matter?

-

Percentages that seem small but somehow feel expensive

-

Statements that are impossible to decipher

-

A nagging feeling you're paying too much, but no way to prove it

The real problem? Most fees are hidden in complex disclosures, industry jargon, and multiple layers of cost.

You don't need a finance degree to understand your fees. You need a system.

Here's what most advisors won't tell you:

The average investor with $500,000 in assets pays between $15,000-$25,000 per year in combined fees. Over 30 years, that's $450,000- $750,000 that could have been YOUR money.

You're Successful in Every Other Area...

So, Why Does Your Financial Situation Feel So Unclear?

You've built a six-figure income.

You've accumulated assets.

You have investment accounts and a financial advisor.

But when you look at your statements, you see confusion:

-

Management fees, fund fees, platform fees, which ones actually matter?

-

Percentages that seem small but somehow feel expensive

-

Statements that are impossible to decipher

-

A nagging feeling you're paying too much, but no way to prove it

The real problem? Most fees are hidden in complex disclosures, industry jargon, and multiple layers of cost.

You don't need a finance degree to understand your fees. You need a system.

Here's what most advisors won't tell you:

The average investor with $500,000 in assets pays between $15,000-$25,000 per year in combined fees. Over 30 years, that's $450,000- $750,000 that could have been YOUR money.

Three Simple Steps to Financial Clarity

Step 1: Gather Your Information

Pull your most recent investment statements, we'll show you exactly where to find the fee information

Step 2: Input Your Numbers

Enter your account values and fee percentages into the calculator's simple, straightforward interface

Step 3: See Your Results

Get instant calculations showing your annual costs, lifetime impact, and potential savings opportunities

The entire process takes 15-20 minutes. The clarity you gain? Priceless.

Three Simple Steps to Financial Clarity

Step 1: Gather Your Information

Pull your most recent investment statements, we'll show you exactly where to find the fee information

Step 2: Input Your Numbers

Enter your account values and fee percentages into the calculator's simple, straightforward interface

Step 3: See Your Results

Get instant calculations showing your annual costs, lifetime impact, and potential savings opportunities

The entire process takes 15-20 minutes. The clarity you gain? Priceless.

Stop Wondering. Start Knowing.

You've worked hard for your money. You deserve to know exactly where it's going.

This calculator gives you the clarity you need to make informed financial decisions without judgment, jargon, or confusing formulas.

It's simple and it takes less than 20 minutes.

The question isn't whether you should audit your fees.

The question is: How much longer can you afford not to?

Stop Wondering. Start Knowing.

You've worked hard for your money. You deserve to know exactly where it's going.

This calculator gives you the clarity you need to make informed financial decisions without judgment, jargon, or confusing formulas.

It's simple and it takes less than 20 minutes.

The question isn't whether you should audit your fees.

The question is: How much longer can you afford not to?

• No credit card required

• Instant access, delivered to your inbox

• Your information is 100% secure and never shared

• Based on the framework I use with private clients